If you read the Mercer Island proposed budget for 2009-2010 (good times, I promise), you’ll see a 1% property tax increase planned in, as well as some other interesting nuggets. The Financial Forecast, page 14, is the best reading.

What were you expecting, a hockey dating controversy? Come on, it’s Mercer Island. Property tax increases are about as racy as we get.

Never thought you’d see a hockey photo in the Mercer Island Blog, did ya?

The 1% Property Tax Increase

Is the maximum increase allowed by Washington state under Initiative 747. The City’s been applying that every year since 2001.

According to the city, the small increase in property taxes isn’t enough keep up with the increase in expenditures. “Throughout the past ten years the cost of basic services has increased an average of 5% per year.” The trend in spending is worth digging into, maybe in a later post.

What About The Parks? They’re Net Zero on Tax

The parks levy passed on Nov. 4. The parks bond did not. The levy will increase property taxes on a $1 million home by about $114 per year, but that’s offset by two other levies that are being sunsetted. The offsetting levies total $113, so the net effect will be just about zero.

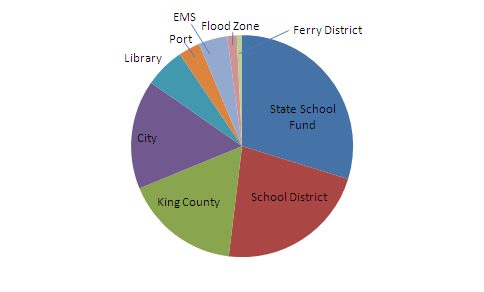

Mercer Island Property Taxes, On the Whole

Are not unreasonable, given the area. I’m not blindly against taxes. They fund a lot of good things- schools, police, and roads, among other nice things. But I keep an eye on them because we’ve got to look at spending increases critically, like any of us would own household budget. Ironically, the less critically we look at public expenditures, the more critically we need to look at private spending, because we’ve got less money.

If you want to comment, December 8th is when the budget ordinance is scheduled for voting. Contact your councilperson if you want to get something done, or comment here if just you want to gripe.